Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Getting Started with Maker Protocol

The Maker Protocol is the platform through which anyone, anywhere can generate the Dai stablecoin against crypto collateral assets. Learn how it works.

Introductory @ MakerDAO.world

@ manual.makerdao.com

@ docs.makerdao.com ← You are here

@ collateral.makerdao.com

@ mips.makerdao.com

MakerDAO is a decentralized organization dedicated to bringing stability to the cryptocurrency economy. The Maker Protocol employs a two-token system. The first being, Dai, a collateral-backed stablecoin that offers stability. The Maker Foundation and the MakerDAO community believe that a decentralized stablecoin is required to have any business or individual realize the advantages of digital money. Second, there is MKR, a governance token that is used by stakeholders to maintain the system and manage Dai. MKR token holders are the decision-makers of the Maker Protocol, supported by the larger public community and various other external parties.

Maker is unlocking the power of decentralized finance for everyone by creating an inclusive platform for economic empowerment; enabling everyone with equal access to the global financial marketplace.

With the new version of the Maker Protocol, Multi Collateral Dai (MCD), being released and live on the main Ethereum network, we wanted to go over a few of the changes and features that it comes with. The biggest change to the Maker Protocol is that it now accepts any Ethereum-based asset as collateral to generate Dai given that it has been approved by MKR holders and has been given specific, corresponding Risk Parameters through the Maker decentralized governance process.

Additionally, there are a few other newly introduced features that come with the MCD upgrade. These new features include:

Support for multiple Vault collateral types (Launching with ETH and BAT)

To open a Vault, head to

To use the DSR, head to Oasis Earn

More robust peg ensuring mechanisms (MKR acting as backstop)

Stability fees paid every block, rather than on Dai repayment

MKR and governance remains the same

The State of the Maker Protocol

Module Name: Vault Core Module

Type/Category: Vault Core Module —> ( Vat.sol, Spot.sol )

Contract Sources:

The Core Module is crucial to the system as it contains the entire state of the Maker Protocol and controls the central mechanisms of the system while it is in the expected normal state of operation.

Vat - The core Vault, Dai, and collateral state is kept in the Vat. The Vat contract has no external dependencies and maintains the central "Accounting Invariants" of Dai.

Spot - poke is the only non-authenticated function in spot. The function takes in a bytes32 of the

The methods in the Vat are written to be as generic as possible and as such have interfaces that can be quite verbose. Care should be taken that you have not mixed the order of parameters. Any module that is authed against the Vat has full root access, and can, therefore, steal all collateral in the system. This means that the addition of a new collateral type (and associated adapter) carries considerable risk.

When the Cat is upgraded, there are multiple references to it that must be updated at the same time (End, Vat.rely

Vat - A bug in the Vat could be catastrophic and could lead to the loss (or locking) of all Dai and Collateral in the system. It could become impossible to modify Vault's or to transfer Dai. Auctions could cease to function. Shutdown could fail.

Spot - A bug in spot would most likely result in the prices for collaterals not being updated anymore. In this case, the system would need to authorize a new spot which would then be able to update the prices. Overall this is not a catastrophic failure as this would only pause all price fluctuation for some period.

Vat - relies upon a set of trusted oracles to provide price data. Should these price feeds fail, it would become possible for unbacked Dai to be minted, or safe Vaults could be unfairly liquidated.

Spot - relies upon a set of trusted oracles to provide price data. Should these price feeds fail, it would become possible for unbacked Dai to be minted, or safe Vaults could be unfairly liquidated.

Vat - Governance can authorize new modules against the Vat. This allows them to steal collateral (slip) or mint unbacked Dai (suck/addition of worthless collateral types). Should the crypto economic protections that make doing so prohibitively expensive fail, the system may be vulnerable and left open for bad actors to drain collateral.

Adapters and Auction contracts for each specific collateral type

Module Name: Collateral Module

Type/Category: DSS —> join.sol, clip.sol

Contract Sources:

The collateral module is deployed for every new ilk (collateral type) added to Vat. It contains all the adapters and auction contracts for one specific collateral type.

For other information related to the collateral module, read the following resources:

The Collateral Module has 3 core components consisting of the join, and flip contracts.

Clipper Contract - see

Join - adapters that are used to deposit/withdraw unlocked collateral into the Vat. Join contains three smart contracts:

GemJoin

ETHJoin

Join contracts help the MCD system operate?Join - the purpose of join adapters is to retain the security of the system, allowing only trusted smart contracts to add/remove value to/from the Vat. The location of collateral deposited/locked in Vaults is in the respective Join adapter.

When a user desires to enter the system and interact with the dss contracts, they must use one of the join contracts.

If there was a contract bug in a join contract and a user was to call join by accident, they can still retrieve their tokens back through the corresponding exit call on the given join contract.

There could potentially be a vat upgrade that would require new join contracts to be created

If a gem contract were to go through a token upgrade or have the tokens frozen while a user's collateral was in the system, there could potentially be a scenario in which the users were unable to redeem their collateral after the freeze or upgrade was finished. This seems to be a small risk though because it would seem likely that the token going through this upgrade would want to work alongside the maker community to be sure this was not an issue.

Potential Phishing Attacks

As the MCD system evolves, we will see many more join contracts, user interfaces, etc. This surfaces the potential for a user to have their funds stolen by a malicious join contract which would send tokens to an external contract or wallet, instead of the vat.

The Maker Protocol's liaison between the Oracles and Core Contracts

Contract Name: spot.sol

Type/Category: DSS —> Core Module

Dai.js is the JavaScript library that helps developers easily build DeFi applications on top of the Maker Protocol, MakerDAO's platform of smart contracts.

is a JavaScript library that makes it easy to build applications on top of MakerDAO's platform of smart contracts. You can use Maker's contracts to open Vaults (formerly known as CDPs), deposit collateral and generate Dai, trade tokens on decentralized exchanges, and more.

The library features a pluggable, service-based architecture, which allows users to easily integrate Maker functionality into their own apps. It also includes convenient configuration presets for out-of-the-box usability and support for both front-end and back-end applications, plus plugins for integrating with Maker governance, hardware wallets, and both Single-Collateral and Multi-Collateral Dai.

A big part of the Maker Protocol is the incentivization of external agents, called Keepers (which can be human but are typically automated bots). Market Maker Keepers work by creating a series of orders in so-called bands (defined later), which are configured with a JSON file containing parameters like spreads, maximum engagement, etc. In short, the market-maker-keeper repository is a set of Keepers that facilitate market making on exchanges. For example, trading Dai motivated by the expected long-term convergence toward the indicated Target Price. This guide is dedicated to showing you how to create your very own Market Maker Keeper Bot as well as educate the community and help both users and developers understand the value of this incredible software. We are proud to say that all of the code needed to get a Market Maker Keeper bot up and running is open-sourced.

DaiJoin.

Each of the join contracts are specifically used for the given token type to be join'ed to the vat. Due to this fact, each join contract has slightly different logic to account for the different types of tokens within the system.

ilkpokeexternalpeekfileVow.relyEndpause.proxy()The methods in the spotter are relatively basic compared to most other portions of dss. There is not much room for user error in the single unauthed method poke. If an incorrect bytes32 is supplied the call will fail. Any module that is authed against the spot has full root access, and can, therefore, add and remove which ilks can be "poked". While not completely breaking the system, this could cause considerable risk.

To override the address of one of the contracts used by Dai.js or a plugin, you can pass the smartContract.addressOverrides option. You need to know the key of the contract in the addresses file to override it.

const service = Maker.create('test' {

smartContract: {

addressOverrides: {

PROXY_REGISTRY: '0xYourAddress'

}

}

});Params: none

Returns: promise (resolves to liquidation ratio)

getLiquidationRatio() returns a decimal representation of the liquidation ratio, e.g. 1.5

Params: none

Returns: promise (resolves to liquidation penalty)

getLiquidationPenalty() returns a decimal representation of the liquidation penalty, e.g. 0.13

Params: none

Returns: promise (resolves to yearly governance fee)

getAnnualGovernanceFee() returns a decimal representation of the annual governance fee, e.g. 0.005.

Note: This is often referred to as the Stability Fee, even though technically the Stability Fee is the fee that is paid in Sai, and the Governance Fee is the fee that is paid in MKR. But since fees are only paid in MKR in Single-Collateral Dai, and only paid in Dai in Multi-Collateral Dai, the fee in Single-Collateral Sai is often referred to as the Stability Fee to be consistent with the term that will be used in Multi-Collateral Dai and to avoid unduly confusing regular users.

USD_ETH price unit.Get the current USD price of the governance token MKR, as a USD_MKR price unit.

Get the current USD price of PETH (pooled ethereum), as a USD_PETH price unit.

Set the current USD price of ETH. This requires the necessary permissions and will only be useful in a testing environment.

Set the current USD price of the governance token MKR. This requires the necessary permissions and will only be useful in a testing environment.

Returns the current WETH to PETH ratio.

const service = maker.service('cdp');const ratio = await service.getLiquidationRatio();const penalty = await service.getLiquidationPenalty();const fee = await service.getAnnualGovernanceFee();const price = maker.service('price');const ethPrice = await price.getEthPrice();const mkrPrice = await price.getMkrPrice();await pethPrice = price.getPethPrice();await price.setEthPrice(475);await price.setMkrPrice(950.00);await price.getWethToPethRatio();The Spot liaison between the oracles and the core contracts. It functions as an interface contract and only stores the current ilk list.

All mathematical operations will revert on overflow or underflow

All methods execute in constant time

ilk a given collateral type

ilk.pip the contract which holds the current price of a given ilk

ilk.mat the liquidation ratio for a given ilk

vat the core of the mcd system

par value of DAI in the reference asset (e.g. $1 per DAI)

Only authorized users can update any variables in contract

poke is the only non-authenticated function in spot. The function takes in a bytes32 of the ilk to be "poked". poke calls two external functions:

peek calls the OSM for the given ilk and takes back in the val and has(a boolean which is false if there was an error in the osm). The second external call only happens if has == true.

When calculating the spot, the par is crucial to this calculation as it defines the relationship between DAI and 1 unit of value in the price. The val is then divided by the par(to get a ratio of val to DAI) and then the resulting value is divided by the ilk.mat. This gives us the current spot price for the given ilk.

file is then called after calculating the spot. This updates the vat with the current liquidation price of the ilk which the function was called for.

The methods in the spotter are relatively basic compared to most other portions of dss. There is not much room for user error in the single unauthed method poke. If an incorrect bytes32 is supplied the call will fail.

Any module that is authed against the spot has full root access, and can, therefore, add and remove which ilks can be "poked". While not completely breaking the system, this could cause considerable risk.

A bug in spot would most likely result in the prices for collaterals not being updated anymore. In this case, the system would need to authorize a new spot which would then be able to update the prices. Overall this is not a catastrophic failure as this would only pause all price fluctuation for some period.

The spot relies upon a set of trusted oracles to provide price data. Should these price feeds fail, it would become possible for unbacked Dai to be minted, or safe Vaults could be unfairly liquidated.

When poke is not called frequently enough, the Vat's spot price will become stale. This could arise for a few reasons including tragedy of the commons or miner collusion and could lead to negative outcomes such as inappropriate liquidations, or the prevention of liquidations that should be possible.

The DAI token contract and all of the adapters DaiJoin adapters.

Module Name: DAI Module

Type/Category: Proxy —> Dai.sol and DaiJoin.sol

Contract Sources:

The origin of DAI was designed to represent any token that the core system considers equal in value to its internal debt unit. Thus, the DAI Module contains the DAI token contract and all of the adapters DaiJoin adapters.

Key Functionalities (as defined in the smart contract)

Mint - Mint to an address

Burn - Burn at an address

Push - Transfer

Pull - Transfer From

Move - Transfer From

Approve - Allow pulls and moves

Permit - Approve by signature

Other

name - Dai Stablecoin

symbol - DAI

version - 1

decimals - 18

totalSupply - Total DAI Supply

balanceOf(usr: address) - User balance

allowance(src: address, dst: address) - Approvals

nonces(usr: address) - Permit nonce

vat - storage of the Vat’s address

ilk - id of the Ilk for which a GemJoin is created for

gem - the address of the ilk

(referenced in Join - Detailed Documentation)

The Dai contract is the user facing ERC20 contract maintaining the accounting for external Dai balances. Most functions are standard for a token with changing supply, but it also notably features the ability to issue approvals for transfers based on signed messages.

Join consists of three smart contracts, one of which is the DaiJoin contract. Each join contract is created specifically to allow the given token type to be joined to the vat. Because of this, each join contract has slightly different logic to account for the different types of tokens within the system. The DaiJoin contract allows users to withdraw their Dai from the system into a standard ERC20 token.

DAI is also susceptible to the known , but should not normally be an issue with unlimited approval. We recommend any users using the approval for a specific amount be aware of this particular issue and use caution when authorizing other contracts to perform transfers on their behalf.

There are limited sources of user error in the join contracts system due to the limited functionality of the system. Barring a contract bug, should a user call join by accident they could always get their tokens back through the corresponding exit call on the given join contract. The main issue to be aware of here would be a well-executed phishing attack. As the system evolves and potentially more join contracts are created, or more user interfaces are made, there is the potential for a user to have their funds stolen by a malicious join contract which does not actually send tokens to the vat, but instead to some other contract or wallet.

There could potentially be a vat upgrade that would require new join contracts to be created.

If a gem contract were to go through a token upgrade or have the tokens frozen while a user's collateral was in the system, there could potentially be a scenario in which the users were unable to redeem their collateral after the freeze or upgrade was finished. This seems to be a small risk though because it would seem likely that the token going through this upgrade would want to work alongside the maker community to be sure this was not an issue.

Contract Name: join.sol

Type/Category: DSS —> Token Adapter Module

Etherscan

Join consists of three smart contracts: GemJoin, ETHJoin, and DaiJoin:

GemJoin - allows standard ERC20 tokens to be deposited for use with the system. ETHJoin - allows native Ether to be used with the system.

DaiJoin - allows users to withdraw their Dai from the system into a standard ERC20 token.

Each join contract is created specifically to allow the given token type to be join'ed to the vat. Because of this, each join contract has slightly different logic to account for the different types of tokens within the system.

vat - storage of the Vat’s address.

ilk - id of the Ilk for which a GemJoin is created for.

gem

Every join contract has 4 public functions: a constructor, join, exit, and cage. The constructor is used on contract initialization and sets the core variables of that join contract. Join and exit are both true to their names. Join provides a mechanism for users to add the given token type to the vat. It has slightly different logic in each variation, but generally resolves down to a transfer and a function call in the vat. Exit is very similar, but instead allows the the user to remove their desired token from the

The GemJoin contract serves a very specified and singular purpose which is relatively abstracted away from the rest of the core smart contract system. When a user desires to enter the system and interact with the dss contracts, they must use one of the join contracts. After they have finished with the dss contracts, they must call exit to leave the system and take out their tokens. When the GemJoin gets caged by an authed address, it can exit collateral from the Vat but it can no longer join new collateral.

User balances for collateral tokens added to the system via join are accounted for in the Vat as Gem according to collateral type Ilk until they are converted into locked collateral tokens (ink) so the user can draw Dai.

The DaiJoin contract serves a similar purpose. It manages the exchange of Dai that is tracked in the Vat and ERC-20 Dai that is tracked by Dai.sol. After a user draws Dai against their collateral, they will have a balance in Vat.dai. This Dai balance can be exit' ed from the Vat using the DaiJoin contract which holds the balance of Vat.dai and mint's ERC-20 Dai. When a user wants to move their Dai back into the Vat accounting system (to pay back debt, participate in auctions, pack bag's in the End, or utilize the DSR, etc), they must call DaiJoin.join. By calling DaiJoin.join

The main source of user error with the Join contract is that Users should never transfer tokens directly to the contracts, they must use the join functions or they will not be able to retrieve their tokens.

There are limited sources of user error in the join contract system due to the limited functionality of the system. Barring a contract bug, should a user call join by accident they could always get their tokens back through the corresponding exit call on the given join contract.

The main issue to be aware of here would be a well-executed phishing attack. As the system evolves and potentially more join contracts are created, or more user interfaces are made, there is the potential for a user to have their funds stolen by a malicious join contract which does not actually send tokens to the vat, but instead to some other contract or wallet.

There could potentially be a vat upgrade that would require new join contracts to be created.

If a gem contract were to go through a token upgrade or have the tokens frozen while a user's collateral was in the system, there could potentially be a scenario in which the users were unable to redeem their collateral after the freeze or upgrade was finished. This scenario likely presents little risk though because the token going through this upgrade would more than likely want to work alongside the Maker community to be sure this was not an issue.

The Chainlog provides valuable information for developers interacting with Maker Protocol deployments. This includes deployments on the following networks:

Ethereum Mainnet (latest release)

Ethereum Goerli Testnet ()

Each release includes the following information:

Contract addresses with link to Etherscan

ABIs

The Chainlog is also available as an onchain smart contract directory () that allows developers to programatically fetch Maker Protocol contract addresses directly in a smart contract. This is useful for integrators that want to future-proof implementations in case a Maker module is updated. You can

Use the mcd:systemData service to look up system-wide parameters. In the code, this is called SystemDataService.

const service = maker.service('mcd:systemData');Returns the base rate applied to all collateral types, in addition to their individual risk premiums.

Returns the debt ceiling for the entire system.

Returns a boolean that is true if emergency shutdown has been triggered.

Dai.js supports plugins, which allow a developer to add functionality (hardware wallet support, exchange support, etc.) for specific needs without increasing the size and dependency list of the core library.

Trezor Plugin for using Trezor with dai.js in a browser environment.

for using Ledger in a browser environment.

for working with the governance contracts.

for atomic trading on maker OTC (Oasis).

for interacting with the maker OTC contract (Oasis).

for interacting with the multi-collateral dai contracts.

for interacting with the single-collateral dai contracts.

Check out the .

Use the 'mcd:savings' service to work with the Dai Savings Rate system. In the code, this is called SavingsService.

All the methods below are asynchronous. join, exit, and exitAll use a proxy contract.

Deposit the specified amount of Dai into the Dai Savings Rate (DSR) contract.

Withdraw the specified amount of Dai from the DSR contract.

Withdraw all Dai owned by the current account from the DSR contract.

Return the amount of Dai in the DSR contract owned by the . Strictly speaking, this method returns the amount of Dai owned by the proxy contract for the current address. to work with the methods above.

Return the amount of Dai in the DSR contract owned by the specified address.

Get the total amount of Dai in the DSR contract for all users.

Get the current annual savings rate.

Introducing the Shutdown Mechanism of the Maker Protocol

The Maker Protocol, which powers Multi Collateral Dai, is a smart-contract system that backs and stabilizes the value of Dai through a dynamic combination of Vaults, autonomous system of smart contracts, and appropriately incentivized external actors. The Dai Target Price is 1 US Dollar, translating to a 1:1 US Dollar soft peg. Shutdown is a process that can be used as a last resort to directly enforce the Target Price to holders of Dai and Vaults, and protect the Maker Protocol against attacks on its infrastructure.

Shutdown stops and gracefully settles the Maker Protocol while ensuring that all users, both Dai holders and Vault holders, receive the net value of assets they are entitled to.

In short, it allows Dai holders to directly redeem Dai for collateral after an Emergency Shutdown processing period.

The process of initiating Emergency Shutdown is decentralized and controlled by MKR voters, who can trigger it by depositing MKR into the Emergency Shutdown Module.

Emergency Shutdown is triggered in the case of serious emergencies, such as long-term market irrationality, hacks, or security breaches.

Emergency Shutdown stops and gracefully settles the Maker Protocol while ensuring that all users, both Dai holders and Vault users, receive the net value of assets they are entitled to.

For more information about the Shutdown of the Maker Protocol, read the below End - Detailed Documentation as well as the

To access system status information, retrieve the ETH CDP Service through Maker.service('cdp').

const service = maker.service('cdp');Params: none

Returns: promise (resolves to system collateralization ratio)

getSystemCollateralization() returns the collateralization ratio for the entire system, e.g. 2.75

Params: none

Returns: promise (resolves to target price)

getTargetPrice() returns the target price of Sai in USD, that is, the value to which Sai is soft-pegged, which historically has been 1. It returns a USD_SAI .

Ensuring the Security of the Maker Protocol and Multi Collateral Dai

The transactionManager service is used to track a transaction's status as it propagates through the blockchain.

Methods in Dai.js that start transactions are asynchronous, so they return promises. These promises can be passed as arguments to the transaction manager to set up callbacks when transactions change their status to pending, mined, confirmed or error.

Pass the promise to transactionManager.listen with callbacks, as shown below.

Note that the confirmed event will not fire unless transactionManager.confirm

Dai.js supports the use of multiple accounts (i.e. private keys) with a single Maker instance. Accounts can be specified in the options for Maker.create or with the addAccount method.

Call useAccount to switch to using an account by its name, or useAccountWithAddress to switch to using an account by its address, and subsequent calls will use that account as the transaction signer.

When the Maker instance is first created, it will use the account named

The Maker Protocol, which powers Multi Collateral Dai (MCD), is a smart contract based system that backs and stabilizes the value of Dai through a dynamic combination of Vaults (formerly known as CDPs), autonomous feedback mechanisms, and incentivized external actors. To keep the system in a stable financial state, it is important to prevent both debt and surplus from building up beyond certain limits. This is where Auctions and Auction Keepers come in. The system has been designed so that there are three types of Auctions in the system: Surplus Auctions, Debt Auctions, and Collateral Auctions. Each auction is triggered as a result of specific circumstances.

Auction Keepers are external actors that are incentivized by profit opportunities to contribute to decentralized systems. In the context of the Maker Protocol, these external agents are incentivized to automate certain operations around the Ethereum blockchain. This includes:

Methods that take numerical values as input can also take instances of token classes that the library provides. These are useful for managing precision, keeping track of units, and passing in wei values. Most methods that return numerical values return them wrapped in one of these classes. There are two types:

currency units, which represent an amount of a type of currency

price units, aka currency ratios, which represent an exchange rate between two currencies.

The classes that begin with USD are price units; e.g. USD_ETH represents the price of ETH in USD. Useful instance methods:

Retrieve the OasisExchangeService (or alternative implementation) through maker.service('exchange'). The exchange service allows to buy and sell DAI, MKR, and other tokens. The default OasisExchangeService implementation uses the OasisDEX OTC market for this.

Requires one of the exchange to be in use.

const service = maker.service('mcd:savings');Seeking out opportunities and starting new auctions

Detect auctions started by other participants

Bid on auctions by converting token prices into bids

More specifically, Keepers participate as bidders in the Debt and Collateral Auctions when Vaults are liquidated and auction-keeper enables the automatic interaction with these MCD auctions. This process is automated by specifying bidding models that define the decision making process, such as what situations to bid in, how often to bid, how high to bid etc. Note that bidding models are created based on individually determined strategies.

For all interested in setting up their own Auction Keeper Bot, please visit the guide below.

dai - the address of the dai token

one - a 10^27 uint used for math in DaiJoin

Dai holders can, after a waiting period determined by MKR voters, swap their Dai for a relative share of all types of collateral in the system. The Maker Foundation will initially offer a web page for this purpose.

Dai holders always receive the same relative amount of collateral from the system, whether they are among the first or last people to process their claims.

Dai holders may also sell their Dai to Keepers (if available) to avoid self-management of the different collateral types in the system.

MCD Bug Bounty Announcement and Security Roadmap Update July 24, 2019

MCD Security Roadmap Update October 23, 2019

Publication of the Runtime Verification Audit December 19, 2019

const base = await service.getAnnualBaseRate();const line = await service.getSystemWideDebtCeiling();const systemRatio = await service.getSystemCollateralization();confirmedBlockCountThere are functions such as lockEth() which are composed of several internal transactions. These can be more accurately tracked by accessing tx.metadatain the callback which contains both the contract and the method the internal transactions were created from.

A TransactionObject also has a few methods to provide further details on the transaction:

hash : transaction hash

fees() : amount of ether spent on gas

timeStamp() : timestamp of when transaction was mined

timeStampSubmitted() : timestamp of when transaction was submitted to the network

defaultYou can check the current account with currentAccount and currentAddress:

In addition to the privateKey account type, there are two other built-in types:

provider: Get the first account from the provider (e.g. the value from getAccounts).

browser: Get the first account from the provider in the browser (e.g. MetaMask), even if the Maker instance is configured to use a different provider.

Plugins can add additional account types. There are currently two such plugins for hardware wallet support:

Install the multiple accounts demo app to see this functionality in action.

toNumber: return the raw JavaScript value. This may fail for very large numbers.

toBigNumber: return the raw value as a BigNumber.

isEqual: compare the values and symbols of two different instances.

toString: show the value in human-readable form, e.g. "500 USD/ETH".

If you would like to use these helper classes outside of Dai.js, check out @makerdao/currency.

Note: this is the same as weth.deposit

convertEthToWeth deposits ETH into the WETH contract

Params: amount of Weth to convert

Returns: promise (resolves to transactionObject once mined)

convertWethToPeth joins WETH into PETH, first giving token allowance if necessary.

Note: this process is not atomic if a token allowance needs to be set, so it's possible for one of the transactions to succeed but not both. See DsProxy for executing multiple transactions atomically. Also, peth.join can be called instead if you do not want the allowance to be set first automatically.

Params: amount of Eth to convert

Returns: promise (resolves to transactionObject once mined)

convertEthToPeth awaits convertEthToWeth, then calls convertWethToPeth

Note: this process is not atomic, so it's possible for some of the transactions to succeed but not all. See Using DsProxy for executing multiple transactions atomically.

Params: amount of Weth to convert

Returns: promise (resolves to transactionObject once mined)

convertWethToEth withdraws Eth from Weth contract

Note: this is the same as weth.withdraw

Params: amount of Peth to convert

Returns: promise (resolves to transactionObject once mined)

convertPethToWeth exits PETH into WETH, first giving token allowance if necessary

Note: this process is not atomic if a token allowance needs to be set, so it's possible for one of the transactions to succeed but not both. See Using DsProxy for executing multiple transactions atomically. Also, peth.exit can be called instead if you do not want the allowance to be set first automatically.

Params: amount of Peth to convert

Returns: promise (resolves to transactionObject once mined)

convertPethToEth awaits convertPethToWeth, then calls convertWethToEth

Note: this process is not atomic, so it's possible for some of the transactions to succeed but not all. See Using DsProxy for executing multiple transactions atomically.

const dead = await service.isGlobalSettlementInvoked();await service.join(DAI(1000));const targetPrice = await service.getTargetPrice();const txMgr = maker.service('transactionManager');

// instance of transactionManager

const open = maker.service('cdp').openCdp();

// open is a promise--note the absence of `await`txMgr.listen(open, {

pending: tx => {

// do something when tx is pending

},

mined: tx => {

// do something when tx is mined

},

confirmed: tx => {

// do something when tx is confirmed

},

error: tx => {

// do someting when tx fails

}

});

await txMgr.confirm(open);

// 'confirmed' callback will fire after 5 blocksawait txMgr.confirm(open, 3);const lock = cdp.lockEth(1);

txMgr.listen(lock, {

pending: tx => {

const {contract, method} = tx.metadata;

if(contract === 'WETH' && method === 'deposit') {

console.log(tx.hash); // print hash for WETH.deposit

}

}

})const maker = await Maker.create({

url: 'http://localhost:2000',

accounts: {

other: {type: privateKey, key: someOtherKey},

default: {type: privateKey, key: myKey}

}

});

await maker.addAccount('yetAnother', {type: privateKey, key: thirdKey});

const cdp1 = await maker.openCdp(); // owned by "default"

maker.useAccount('other');

const cdp2 = await maker.openCdp(); // owned by "other"

maker.useAccount('yetAnother');

const cdp3 = await maker.openCdp(); // owned by "yetAnother"

await maker.addAccount({type: privateKey, key: fourthAccount.key}); // the name argument is optional

maker.useAccountWithAddress(fourthAccount.address);

const cdp4 = await maker.openCdp(); //owned by the fourth account> maker.currentAccount()

{ name: 'other', type: 'privateKey', address: '0xfff...' }

> maker.currentAddress()

'0xfff...'const maker = await Maker.create({

url: 'http://localhost:2000',

accounts: {

// this will be the first account from the provider at

// localhost:2000

first: {type: 'provider'},

// this will be the current account in MetaMask, and it

// will send its transactions through MetaMask

second: {type: 'browser'},

// this account will send its transactions through the

// provider at localhost:2000

third: {type: 'privateKey', key: myPrivateKey}

}

})import TrezorPlugin from '@makerdao/dai-plugin-trezor-web';

import LedgerPlugin from '@makerdao/dai-plugin-ledger-web';

const maker = await Maker.create({

plugins: [

TrezorPlugin,

LedgerPlugin,

],

accounts: {

// default derivation path is "44'/60'/0'/0/0"

myTrezor: {type: 'trezor', path: derivationPath1},

myLedger: {type: 'ledger', path: derivationPath2}

}

});import Maker from '@makerdao/dai';

// Multi-Collateral Dai

import { ETH, BAT, DAI } from '@makerdao/dai-plugin-mcd';

const maker = await Maker.create(...);

const mgr = maker.service('mcd:cdpManager');

// lock BAT into a new vault and draw Dai

const vault = await mgr.openLockAndDraw(

'BAT-A',

BAT(100),

DAI(100)

);

// Single-Collateral Sai

const {

MKR,

SAI,

ETH,

WETH,

PETH,

USD_ETH,

USD_MKR,

USD_SAI

} = Maker;

// These are all identical:

// each method has a default type

cdp.lockEth(0.25);

cdp.lockEth('0.25');

// you can pass in a currency unit instance

cdp.lockEth(ETH(0.25));

// currency units have convenient converter methods

cdp.lockEth(ETH.wei(250000000000000000));

const eth = ETH(5);

eth.toString() == '5.00 ETH';

const price = USD_ETH(500);

price.toString() == '500.00 USD/ETH';

// multiplication handles units

const usd = eth.times(price);

usd.toString() == '2500.00 USD';

// division does too

const eth2 = usd.div(eth);

eth2.isEqual(eth);const conversionService = maker.service('conversion');return await conversionService.convertEthToWeth(ETH(10));return await conversionService.convertWethToPeth(WETH(10));return await conversionService.convertEthToPeth(ETH(10));return await conversionService.convertconvertWethToEth(WETH(10));return await conversionService.convertPethToWeth(PETH(10));return await conversionService.convertPethToEth(PETH(10));ilkdai - the address of the dai token.

one - a 10^27 uint used for math in DaiJoin.

live - an access flag for the join adapter.

dec - decimals for the Gem.

vatCageburnVat.daiDaiJoinVatDai.totalSupplyVat.dai(DaiJoin)DaiJoincageauthexitSell a set amount of DAI and receive another token in return.

Parameters

daiAmount - Amount of DAI to sell.

tokenSymbol - Token to receive in return.

minFillAmount - Minimum amount to receive in return.

Returns: promise (resolves to once mined)

Buy a set amount of DAI and give another token in return.

Parameters

daiAmount - Amount of DAI to buy.

tokenSymbol - Token to give in return.

minFillAmount - Maximum amount to give in return.

Returns: promise (resolves to once mined)

OasisOrders have a few methods: fillAmount: amount of token received in exchange fees(): amount of ether spent on gas created(): timestamp of when transaction was mined

Use the 'mcd:cdpType' service to look up parameters for different collateral types in the system. In the code, this is called CdpTypeService.

This is a list of , initialized during Maker.create.

Return the for the specified currency and/or .

The name of the collateral type as a string, e.g. "ETH-A".

The total amount of collateral locked in all vaults of this collateral type.

The total Dai debt drawn against all vaults of this collateral type.

The debt ceiling for this collateral type.

Vaults of this type become unsafe (subject to liquidation) when their ratio between USD value of collateral and Dai drawn is less than or equal to this amount.

The USD price of this collateral type's token, using recent price feed data, as a . (See "A note on caching" above).

The penalty added to the Dai amount to be raised at auction when a vault is liquidated, as a percentage. e.g. if the penalty is 13%, this value will be BigNumber(0.13).

The annual stability fee (risk premium) of the collateral type, not including the , as a BigNumber. e.g. if the rate is 5%, this value will be BigNumber(0.05).

When a vault instance is created, its data is pre-fetched from the blockchain, allowing the properties below to be read synchronously. This data is cached in the instance. To refresh this data, do the following:

To refresh the data for all collateral type instances at once:

Get a token object through the getToken(tokenSymbol) function on the tokenService.

The list of tokens that can be passed into getToken() are: SAI, MKR, WETH, PETH, ETH.

This list can also be obtained with tokenService.getTokens(). This function returns a string representation of the token symbol, e.g. 'SAI', which can also be passed into getToken.

When the Multi-Collateral Dai plugin is in use, getToken('DAI') will return a token object for Dai.

Most of the methods below can be called on any token object. deposit and withdraw are for WETH only, and join and exit are for PETH only.

Params:

tokenOwner - address of token owner

spender - address of token spender

Returns: promise (resolves to token allowance)

allowance returns a representing the token allowance.

Params: none

Returns: promise (resolves balance of current account)

balance returns a representing the token balance of the current account

Params: address to check

Returns: promise (resolves balance of address)

balanceOf returns a representing the token balance of the supplied account.

Params: none

Returns: promise (resolves total supply of token)

totalSupply returns a representing the total token supply

Params:

spender - address of token spender

amount - amount of token to allow

Returns: promise (resolves to once mined)

approve approves the spending address to spend up to amount of msg.sender's tokens.

Params: address of token spender

Returns: promise (resolves to once mined)

approveUnlimited approves the spending address to spend the maximum amount of msg.sender's tokens.

Params:

to - address to send to

amount - amount of token to send

Returns: promise (resolves to once mined)

transfer transfers amount of token to to address.

Params:

from - address to send tokens from

to - address to send to

amount - amount of token to send

transferFrom() transfers amount of token from from address to to address. Transaction will fail if msg.sender does not have allowance to transfer the amount of tokens from the from address.

Params: amount of Eth to deposit

Returns: promise (resolves to once mined)

deposit converts amount of Eth to amount of Weth.

Params: amount of Weth to withdraw

Returns: promise (resolves to once mined)

withdraw converts amount of Weth to amount of Eth.

Params: amount of Weth to join

Returns: promise (resolves to once mined)

join converts amount of Weth to Peth, at the .

Params: amount of Peth to exit

Returns: promise (resolves to once mined)

withdraw converts amount of Peth to Weth, at the .

The Maker Protocol's Oracles

Module Name: Oracle Module

Type/Category: Oracles —> OSM.sol & Median.sol

You can take advantage of the pluggable architecture of this library by choosing different implementations for services, and/or adding new service roles altogether. A service is just a Javascript class that inherits from either PublicService, PrivateService, or LocalService, and contains public method(s).

It can depend on other services through our built-in , and can also be configured through the Maker config file / config options.

In-line comments on the Maker Protocol's Core Smart Contracts

Understanding the various terms used in our smart contracts can involve a significant time investment for developers looking at the codebase for the first time. Due to this fact, we need resources in various formats to ensure they can get up and running quickly. We believe, in order to complement the technical documentation on docs.makerdao.com, that highlighting sections of the codebase and annotating it with comments can surface relevant information developers need while reading the raw contracts in order to understand the contracts better.

Examples of how annotations may be useful for developers:

Allowing MKR users to vote with a hot or cold wallet using a proxy voting identity

Contract Name: VoteProxy.sol

Type/Category: Proxy Module

const exchange = maker.service('exchange');// Sell 100.00 DAI for 0.30 WETH or more.

const sellOrder = await exchange.sellDai('100.0', 'WETH', '0.30');// Buy 100.00 DAI for 0.30 WETH or less.

const buyOrder = await exchange.buyDai('100.0', 'WETH', '0.35');const buyOrder = await exchange.buyDai('100.0', 'WETH', '0.35');

const fillAmount = buyOrder.fillAmount();

const gasPaid = buyOrder.fees();

const created = buyOrder.created();const service = maker.service('mcd:cdpType');const tokenService = maker.service('token');

const sai = tokenService.getToken('SAI');

const weth = tokenService.getToken('WETH');

const peth = tokenService.getToken('PETH');Highlight terms to display their definitions

Ex: ink, art

Explain various input parameters in-depth

Ex: Explain the precise role of users defined as gal or guy within input parameters.

Link to sections of other smart contracts from where function calls typically originate from

Ex: heal in Vat is called from Vow

Additional context to Maker specific design practices that other smart contract developers might not be accustomed to

Ex: Show the event log signature produced by the note modifier on a function.

Help developers navigate through scenarios that result in calls across multiple smart contracts

Ex: Keepers participating in collateral auctions kick the process with bite on Cat, bad debt is settled in Vat, accounted for in Vow, and a series of transactions on flip until they receive collateral they purchased for a discount.

Superimposing the operational view of the system on all functions will help developers build richer mental models of the Maker Protocol.

Ex: Annotating a function's auth modifier and mentioning the smart contracts authorized to call it.

Annotations will also serve as an open and collaborative discussion layer that helps developers discuss and evolve their understanding of the smart contracts over time.

Hypothesis is a web-based tool that we use to annotate the codebase hosted on our Github org.

Check out the annotations of the Vat smart contract here.

Hypothesis annotations can be viewed by expanding a sidebar on the top right corner of your browser window.

There are three options to view annotations on a webpage:

Install the chrome extension from the web store.

Follow instructions to setup a bookmarklet

Append https://via.hypothes.is to a URL.

MakerDAO restricted group- everyone is allowed to read annotations but only approved members can contribute here.

Public MakerDAO group that is open for everyone to both read and contribute.

The code below creates a CDP, locks ETH into it, and draws out Sai.

The services and objects below are used to work with Single-Collateral Sai.

Returns: promise (resolves to new CDP object once mined)

openCdp() will create a new CDP, and then return the CDP object, which can be used to access other CDP functionality. The promise will resolve when the transaction is mined.

Returns: promise (resolves to CDP object)

getCdp(id) creates a CDP object for an existing CDP. The CDP object can then be used to interact with your CDP.

Once you have an instance of a CDP, you can use CDP instance methods to read its state and perform actions.

An event name passed to any event emitter method can contain a wildcard (the *character). A wildcard may appear as foo/*, foo/bar/*, or simply *.

* matches one sub-level.

e.g. price/* will trigger on both price/USD_ETH and price/MKR_USD but not price/MKR_USD/foo.

** matches all sub-levels.

e.g. price/** will trigger on price/USD_ETH, price/MKR_USD, and price/MKR_USD/foo.

Event Object

Triggered events will receive the object shown on the right.

<event_type> - the name of the event

<event_payload> - the new state data sent with the event

<event_sequence_number> - a sequentially increasing index

<latest_block_when_emitted> - the current block at the time of the emit

Event Name

Payload

price/ETH_USD

{ price }

price/MKR_USD

{ price }

price/WETH_PETH

{ ratio }

Event Name

Payload

web3/INITIALIZED

{ provider: { type, url } }

web3/CONNECTED

{ api, network, node }

web3/AUTHENTICATED

{ account }

web3/DEAUTHENTICATED

{ }

web3/DISCONNECTED

{ }

Event Name

Payload

COLLATERAL

{ USD, ETH }

DEBT

{ dai }

Here are the steps to add a new service called ExampleService:

(1) In the src directory, create an ExampleService.js file in one of the subdirectories.

(2) In src/config/DefaultServiceProvider.js, import ExampleService.js and add it to the _services array

(3) Create a class called ExampleService in ExampleService.js

(4) The service must extend one of:

PrivateService - requires both a network connection and authentication

PublicService - requires just a network connection

LocalService - requires neither

See the Service Lifecycle section below for more info

(5) In the constructor, call the parent class's constructor with the following arguments:

The name of the service. This is how the service can be referenced by other services

An array of the names of services to depend on

(6) Add the necessary public methods

(7) If your service will be used to replace a default service (the full list of default service roles can be found in src/config/ConfigFactory), then skip this step. Otherwise, you'll need to add your new service role (e.g. "example") to the ServiceRoles array in src/config/ConfigFactory.

(8) Create a corresponding ExampleService.spec.js file in the test directory. Write a test in the test file that creates a Maker object using your service.

(9) (Optional) Implement the relevant service lifecycle functions (initialize(), connect(), and authenticate()). See the Service Lifecycle section below for more info

(10) (Optional) Allow for configuration. Service-specific settings can be passed into a service by the Maker config file or config options. These service-specific settings can then be accessed from inside a service as the parameter passed into the initialize function (see the Service Lifecycle section below)

The three kinds of services mentioned in step 4 above follow the following state machine diagrams in the picture below.

To specify what initializing, connecting and authenticating entails, implement the initialize(), connect(), and authenticate() functions in the service itself. This will be called while the service's manager brings the service to the corresponding state.

A service will not finish initializing/connecting/authenticating until all of its dependent services have completed the same state (if applicable - for example a LocalService is considered authenticated/connected in addition to initialized, if it has finished initializing). The example code here shows how to wait for the service to be in a certain state.

One way to add an event is to “register” a function that gets called on each new block, using the event service's registerPollEvents() function. For example, here is some code from the price service. this.getEthPrice() will be called on each new block, and if the state has changed from the last call, a price/ETH_USD event will be emitted with the payload { price: [new_price] }.

Another way to an add an event is to manually emit an event using the event service's emit function. For example, when the Web3Service initializes, it emits an event that contains info about the provider.

Note that calling registerPollEvents and emit() directly on the event service like in the previous two examples will register events on the "default" event emitter instance. However, you can create a new event emitter instance for your new service. For example, the CDP object defines it's own event emitter, as can be seen here, by calling the event service's buildEmitter() function.

service.cdpTypes.forEach(type => console.log(type.ilk));

// ETH-A

// BAT-A

// USDC-A// this will error if more than one type is defined for ETH

const type = service.getCdpType(ETH);

// disambiguate using the ilk name string:

const ethA = service.getCdpType(null, 'ETH-A');console.log(type.price.toString()); // "9000.01 ETH/USD"vault.reset();

await vault.prefetch();service.resetAllCdpTypes();

await service.prefetchAllCdpTypes();const allowance = await dai.allowance('0x...owner', '0x...spender');const balance = await dai.balance();const balanceOf = await dai.balanceOf('0x...f00');const totalSupply = await dai.totalSupply();return await dai.approve('0x...f00', DAI(10));return await dai.approveUnlimited('0x...f00');return await dai.transfer('0x...f00', DAI(10));return await dai.transferFrom('0x...fr0m', '0x...t0', DAI(10));return await weth.deposit(ETH(10));return await weth.withdraw(WETH(10));return await peth.join(WETH(10));return await peth.exit(PETH(10));import { ScdPlugin } from '@makerdao/dai-plugin-scd';

// or

const { ScdPlugin } = require('@makerdao/dai-plugin-scd');import Maker from '@makerdao/dai';

import { ScdPlugin } from '@makerdao/dai-plugin-scd';

async function openLockDraw() {

const maker = await Maker.create("http", {

plugins: [ScdPlugin],

privateKey: YOUR_PRIVATE_KEY,

url: 'https://kovan.infura.io/v3/YOUR_INFURA_PROJECT_ID'

});

await maker.authenticate();

const cdpService = await maker.service('cdp');

const cdp = await cdpService.openCdp();

await cdp.lockEth(0.25);

await cdp.drawSai(50);

const debt = await cdp.getDebtValue();

console.log(debt.toString); // '50.00 SAI'

}

openLockDraw();const cdpService = await maker.service('cdp');

const newCdp = await cdpService.openCdp();const cdpService = await maker.service('cdp');

const cdp = await cdpService.getCdp(614);{

type: <event_type>,

payload: <event_payload>, /* if applicable */

index: <event_sequence_number>,

block: <latest_block_when_emitted>

}maker.on('price/ETH_USD', eventObj => {

const { price } = eventObj.payload;

console.log('ETH price changed to', price);

})maker.on('web3/AUTHENTICATED', eventObj => {

const { account } = eventObj.payload;

console.log('web3 authenticated with account', account);

})cdp.on('DEBT', eventObj => {

const { dai } = eventObj.payload;

console.log('Your cdp now has a dai debt of', dai);

})//example code in ExampleService.js for steps 3-6

import PublicService from '../core/PublicService';

export default class ExampleService extends PublicService {

constructor (name='example') {

super(name, ['log']);

}

test(){

this.get('log').info('test');

}//example code in ExampleService.spec.js for step 8

import Maker from '../../src/index';

//step 8: a new service role ('example') is used

test('test 1', async () => {

const maker = await Maker.create('http', {example: "ExampleService"});

const exampleService = customMaker.service('example');

exampleService.test(); //logs "test"

});

//step 8: a custom service replaces a default service (Web3)

test('test 2', async () => {

const maker = await Maker.create('http', {web3: "MyCustomWeb3Service"});

const mycustomWeb3Service = maker.service('web3');

});//step 10: in ExampleService.spec.js

const maker = await Maker.create('http', {

example: ["ExampleService", {

exampleSetting: "this is a configuration setting"

}]

});

//step 10: accessing configuration settings in ExampleService.js

initialize(settings) {

if(settings.exampleSetting){

this.get('log').info(settings.exampleSetting);

}

}//example initialize() function in ExampleService.js

initialize(settings) {

this.get('log').info('ExampleService is initializing...');

this._setSettings(settings);

}const maker = await Maker.create('http', {example: "ExampleService"});

const exampleService = customMaker.service('example');

//wait for example service and its dependencies to initialize

await exampleService.manager().initialize();

//wait for example service and its dependencies to connect

await exampleService.manager().connect();

//wait for example service and its dependencies to authenticate

await exampleService.manager().authenticate();

//can also use callback syntax

exampleService.manager().onConnected(()=>{

/*executed after connected*/

});

//wait for all services used by the maker object to authenticate

maker.authenticate();//in PriceService.js

this.get('event').registerPollEvents({

'price/ETH_USD': {

price: () => this.getEthPrice()

}

});

//in Web3Service.js

this.get('event').emit('web3/INITIALIZED', {

provider: { ...settings.provider }

});

//in the constructor in the Cdp.js

this._emitterInstance = this._cdpService.get('event').buildEmitter();

this.on = this._emitterInstance.on;

this._emitterInstance.registerPollEvents({

COLLATERAL: {

USD: () => this.getCollateralValueInUSD(),

ETH: () => this.getCollateralValueInEth()

},

DEBT: {

dai: () => this.getDebtValueInDai()

}

});An oracle module is deployed for each collateral type, feeding it the price data for a corresponding collateral type to the Vat. The Oracle Module introduces the whitelisting of addresses, which allows them to broadcast price updates off-chain, which are then fed into a median before being pulled into the OSM. The Spot'ter will then proceed to read from the OSM and will act as the liaison between the oracles and dss.

The Oracle Module has 2 core components consisting of the Median and OSM contracts.

The Median provides Maker's trusted reference price. In short, it works by maintaining a whitelist of price feed contracts which are authorized to post price updates. Every time a new list of prices is received, the median of these is computed and used to update the stored value. The median has permissioning logic which is what enables the addition and removal of whitelisted price feed addresses that are controlled via governance. The permissioning logic allows governance to set other parameters that control the Median's behavior—for example, the bar parameter is the minimum number of prices necessary to accept a new median value.

The OSM (named via acronym from "Oracle Security Module") ensures that new price values propagated from the Oracles are not taken up by the system until a specified delay has passed. Values are read from a designated DSValue contract (or any contract that implements the read() and peek() interface) via the poke() method; the read() and peek() methods will give the current value of the price feed, and other contracts must be whitelisted in order to call these. An OSM contract can only read from a single price feed, so in practice one OSM contract must be deployed per collateral type.

You can read straight from the median and in return, you would get a more real-time price. However, this depends on the cadence of updates (calls to poke).

The OSM is similar but has a 1-hour price delay. It has the same process for reading (whitelist, auth, read and peek) as a median. The way the OSM works, is you cannot update it directly but you can poke it to go and read from something that also has the same structure (the peek method - in this case, its the median but you can set it to read from anything that conforms to the same interface).

Whenever the OSM reads from a source, it queues the value that it reads for the following hour or following hop property, which is set to 1 hour (but can be anything). When it is poke'd, it reads the value of the median and it will save the value. Then the previous value becomes that, so it is always off by an hour. After an hour passes, when poked, the value that it saved becomes the current value and whatever value is in the median becomes the future value for the next hour.

spot - if you poke it with an ilk (ex: ETH) it will read form the OSM and if the price is valid, it updates.

In relation to the Spot the oracle module handles how market prices are recorded on the blockchain. The Spotter operates as the interface contract, which external actors can use to retrieve the current market price from the Oracle module for the specified collateral type. The Vat in turn reads the market price from the spotter.

Median - there is currently no way to turn off the oracle (failure or returns false) if all the oracles come together and sign a price of zero. This would result in the price being invalid and would return false on peek, telling us to not trust the value.

OSM

poke() is not called promptly, allowing malicious prices to be swiftly uptaken.

Authorization Attacks and Misconfigurations.

Read more

'browser'

Use this preset when using the library in a browser environment. It will attempt to connect using window.ethereum or window.web3.

'http'

Connect to a JSON-RPC node. Requires url to be set in the options.

'test'

Use a local node (e.g. Ganache) running at http://127.0.0.1:2000, and sign transactions using node-managed keys.

privateKey

Optional. The private key used to sign transactions. If this is omitted, the first account available from the Ethereum provider will be used. Only used with the 'http' preset.

If this is omitted and the provider does not have an unlocked account, the maker object will start in read-only mode.

url

The URL of the node to connect to. Only used with the 'http' preset.

web3.transactionSettings

Object containing transaction options to be applied to all transactions sent through the library.

Default value: { gasLimit: 4000000 }

web3.confirmedBlockCount

Number of blocks to wait after a transaction has been mined when calling confirm. See for further explanation.

Default value: 5

web3.inject

For advanced users. You can inject your own custom instance of a Web3 provider with this, instead of using the default HttpProvider.

log

Set this to false to reduce the verbosity of logging.

autoAuthenticate

Set this to false to create the Maker instance without connecting yet. If so, you must run await maker.authenticate() before using any other methods.

Returns: service object

Return a service instance that was included in this instance of maker.

The MCD plugin defines several services for working with Multi-Collateral Dai. Review Getting started to see how to add the plugin.

'mcd:cdpManager': for working with Vaults.

'mcd:cdpType': for reading parameters and live data (totals and prices) for collateral types.

'mcd:savings': for working with the Dai Savings Rate.

: for reading system-wide parameters.

As mentioned above, the Maker instance can be used in read-only mode, if you just want to read data from the blockchain without signing any transactions. Simply omit the privateKey option.

You can start in read-only mode and still add an account with the ability to sign transactions later on.

The VoteProxy contract allows for MKR users to vote with a hot or cold wallet using a proxy voting identity instead of interacting directly with the chief. In addition to supporting two different voting mechanisms, the vote proxy also minimizes the time that MKR owners need to have their wallet(s) online.

approvals: A mapping of candidate addresses to their uint weight.

slate - A mapping of bytes32 to address arrays. Represents sets of candidates. Weighted votes are given to slates.

votes: A mapping of voter addresses to the slate they have voted for.

GOV: DSToken used for voting.

IOU: DSToken issued in exchange for locking GOV tokens.

The VoteProxy contract enables MKR owners to vote with the full weight of the MKR they own, for both for Governance and Executive votes. As mentioned above, this process also reduces the risk for MKR users when voting with a cold wallet. This is done by allowing the MKR owner to designate a “hot wallet” which is used to transfer MKR to the proxy and can only be used for voting on Governance and Executive votes. The “hot wallet” can then be used to lock MKR in the voting system and draw it back to their cold wallet.

auth - Checks to confirm that the sender must be a Cold or Hot Wallet.

lock - Charges the user wad MKR tokens, issues an equal amount of IOU tokens to the VoteProxy, and adds wad weight to the candidates on the user's selected slate.

free - Charges the user wad IOU tokens, issues an equal amount of MKR tokens to the user, and subtracts wad weight from the candidates on the user's selected slate.

vote - Saves a set of ordered addresses as a slate, moves the voter's weight from their current slate to the new slate, and returns the slate's identifier.

vote(bytes32 slate) - Removes voter's weight from their current slate and adds it to the specified slate.

One-time proxy setup cost

As a new proxy contract user, you will need to set it up before you can use it for future voting. The price of the setup will depend on the current Ethereum gas price but will ultimately make voting easier and safer for users.

Any MKR moved/transferred from a user's vote proxy during a Polling vote, will be subtracted/removed from any existing poll that a user has voted on. For your vote to count, you must ensure the MKR is in your wallet when the poll ends.

Note: For the users who don't want to use the VoteProxy, they can now vote directly with a single wallet, by depositing directly into Chief and then voting with their wallet.

The loss of private keys for both the hot and cold wallet will prevent you from voting.

The Maker Protocol's Core Accounting System

Contract Name: Vat.sol

Type/Category: DSS —> Core System Accounting

The Vat is the core Vault engine of dss. It stores Vaults and tracks all the associated Dai and Collateral balances. It also defines the rules by which Vaults and balances can be manipulated. The rules defined in the Vat are immutable, so in some sense, the rules in the Vat can be viewed as the constitution of dss.

gem: collateral tokens.

dai: stablecoin tokens.

sin: unbacked stablecoin (system debt, not belonging to any urn).

Note: art and Art represent normalized debt, i.e. a value that when multiplied by the correct rate gives the up-to-date, current stablecoin debt.

debt is the sum of all dai (the total quantity of dai issued).

vice is the sum of all sin (the total quantity of system debt).

Ilk.Art

gem can always be transferred to any address by it's owner.

dai can only move with the consent of it's owner.

dai can always be transferred to any address by it's owner.

The core Vault, Dai, and collateral state is kept in the Vat. The Vat contract has no external dependencies and maintains the central "Accounting Invariants" of Dai. The core principles that apply to the vat are as follows:

Dai cannot exist without collateral:

An ilk is a particular type of collateral.

Collateral gem is assigned to users with slip.

Collateral gem is transferred between users with flux

2. The Vault data structure is the Urn:

has ink - encumbered collateral

has art - encumbered, normalized debt

3. Similarly, a collateral is an Ilk:

has Art - encumbered, normalized debt

has rate - debt scaling factor (discussed further below)

has spot - price with safety margin

Note: Above, when using the term "encumbered", this refers to being "locked in a Vault".

Vaults are managed via frob(i, u, v, w, dink, dart), which modifies the Vault of user u, using gem from user vand creating dai for user w.

Vaults are confiscated via grab(i, u, v, w, dink, dart), which modifies the Vault of user u

fold(bytes32 ilk, address u, int rate)An ilk's rate is the conversion factor between any normalized debt (art) drawn against it and the present value of that debt with accrued fees. The rate parameter to fold is actually the change in the Ilk.rate value, i.e. a difference of scaling factors (new - old). It is a signed integer, and hence current account values may increase or decrease. The quantity Ilk.Art*rate is added to the dai balance of the address u (representing an increase or decrease in system surplus); the debt balances of all Vaults collateralized with the specified Ilk are updated implicitly via the addition of rate to Ilk.rate.

For more information on Rates and System Stabilization, see the Rates Module and System Stabilizer Module documentation below:

The methods in the Vat are written to be as generic as possible and as such have interfaces that can be quite verbose. Care should be taken that you have not mixed the order of parameters.

Any module that is authed against the Vat has full root access, and can therefore steal all collateral in the system. This means that the addition of a new collateral type (and associated adapter) carries considerable risk.

A bug in the Vat could be catastrophic and could lead to the loss (or locking) of all Dai and Collateral in the system. It could become impossible to modify Vault's or to transfer Dai. Auctions could cease to function. Shutdown could fail.

The Vat relies upon a set of trusted oracles to provide price data. Should these price feeds fail, it would become possible for unbacked Dai to be minted, or safe Vaults could be unfairly liquidated.

Governance can authorize new modules against the Vat. This allows them to steal collateral (slip) or mint unbacked Dai (suck / addition of worthless collateral types). Should the cryptoeconomic protections that make doing so prohibitively expensive fail, the system may be vulnerable and left open for bad actors to drain collateral.

The Vat relies on external Adapter contracts to ensure that the collateral balances in the Vat represent real external collateral balances. Adapter contracts are authorized to make arbitrary modifications to all collateral balances. A faulty collateral adapter could result in the loss of all collateral in the system.

The ESM is the trigger system for the shutdown of the Maker Protocol

Contract Name: esm.sol

Type/Category: Emergency Shutdown Module

The Emergency Shutdown Module (ESM) is a contract with the ability to call End.cage() to trigger the Shutdown of the Maker Protocol.

Key Functionalities (as defined in the smart contract)

rely - Grant an address admin powers

deny - Revoke admin powers from an address

file - Allow admin to update threshold min and address of end

cage - Permanently disable the shutdown module

fire - Trigger shutdown by calling End.cage

denyProxy - Following the wards rely/deny pattern, calls deny on a given contract

join - Deposit MKR to the shutdown module

burn - Burn any MKR deposited into the shutdown module

Other

gem - MKR Token contract [address]

wards(admin: address) - Whether an address has admin powers [address: uint]

sum(usr: address) - MKR join balance by user [address: uint]

Sum - Total MKR deposited [uint]

min - Minimum MKR amount required for fire and denyProxy [uint]

end - The End contract [address]

live - Whether the contract is live (not caged) [uint]

MKR holders that wish to trigger Shutdown must join MKR into the ESM. When the ESM's internal Sum variable is equal to or greater than the minimum threshold (min), the ESM's fire() and denyProxy() methods may be called by anyone. The fire() method, in turn, calls End.cage(), which starts the Shutdown process.

The ESM is intended to be used in a few potential scenarios:

To mitigate malicious governance

To prevent the exploitation of a critical bug (for example one that allows collateral to be stolen)

In the case of a malicious governance attack, the joiners will have no expectation of recovering their funds (as that would require a malicious majority to pass the required vote), and their only option is to set up an alternative fork in which the majority's funds are slashed and their funds are restored.

In other cases, the remaining MKR holders may choose to refund the ESM joiners by minting new tokens.

Note: Governance can disarm the ESM by calling cage() (this is distinct from End.cage()).

It is important for users to keep in mind that joining MKR into the ESM is irreversible—they lose it forever, regardless of whether they successfully trigger Shutdown. While it is possible that the remaining MKR holders may vote to mint new tokens for those that lose them triggering the ESM, there is no guarantee of this.

An entity wishing to trigger the ESM but possessing insufficient MKR to do so independently must proceed with caution. The entity could simply send MKR to the ESM to signal its desire and hope others join in; this, however, is poor strategy. Governance, whether honest or malicious, will see this, and likely move to de-authorize the ESM before the tipping point can be reached. It is clear why malicious governance would do so, but honest governance might act in a similar fashion—e.g. to prevent the system from being shut down by trolls or simply to maintain a constant threshold for ESM activation. (Honest governance, or even deceptive malicious governance, would be expected to then replace the ESM.) If governance succeeds in this, the entity has simply lost MKR without accomplishing anything.

If an entity with insufficient MKR wishes to trigger the ESM, it is better off first coordinating with others either off-chain or ideally via a trustless smart contract.. If a smart contract is used, it would be best if it employed zero-knowledge cryptography and other privacy-preserving techniques (such as transaction relayers) to obscure information such as the current amount of MKR committed and the addresses of those in support.

If an entity thinks others will join in before governance can react (e.g. if the delay for governance actions is very long), it is still possible that directly sending insufficient MKR to the ESM may work, but it carries a high degree of risk. Governance could even collude with miners to prevent cage calls, etc if they suspect an ESM triggering is being organized and wish to prevent it.

The ESM itself does not have an isolated failure mode, but if the other parts of the system do not have proper authorization configurations (e.g. the End contract does not authorize the ESM to call cage()), then the ESM's fire() method may be unable to trigger the Shutdown process even if sufficient MKR has been committed to the contract.

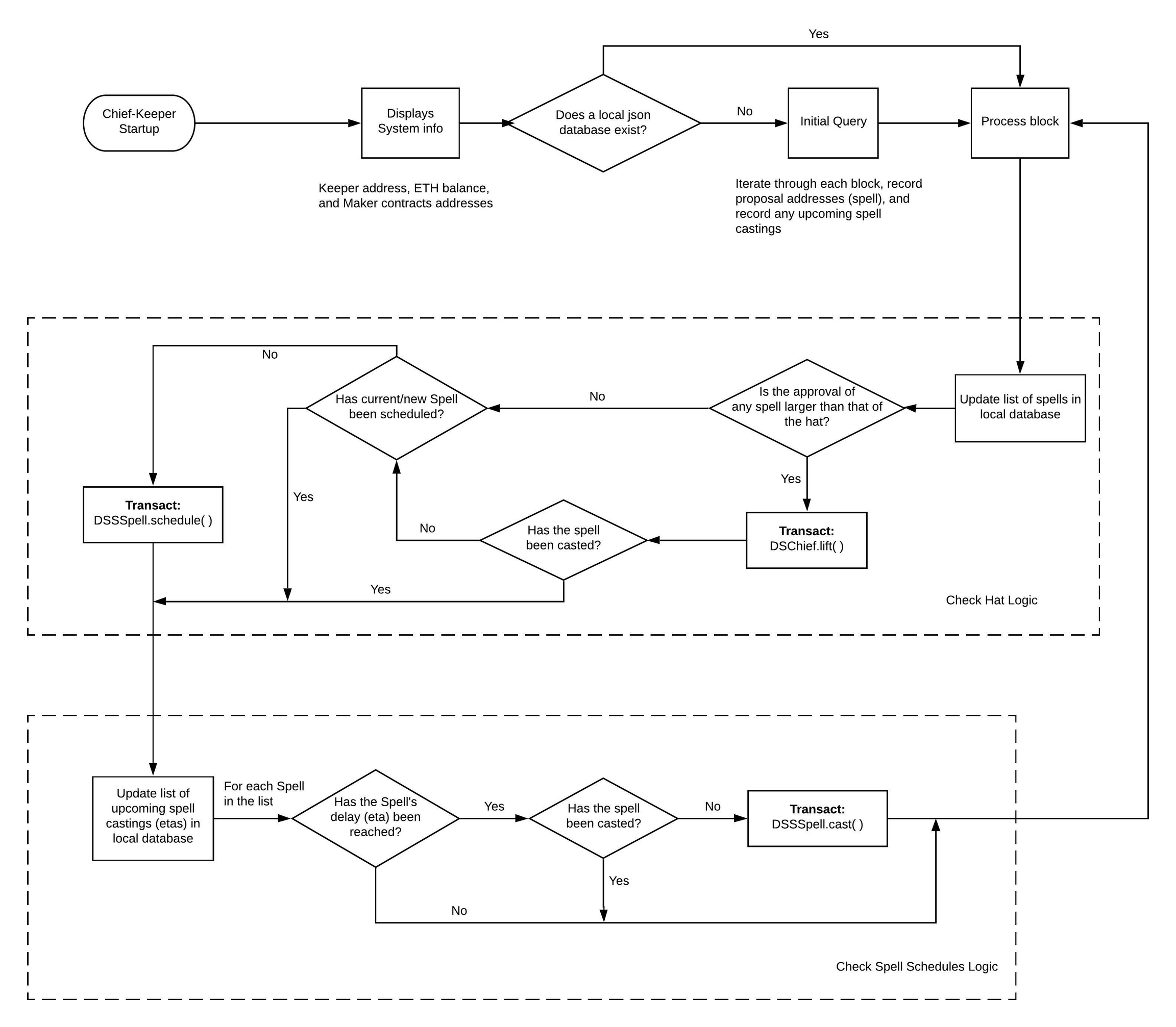

Keeper that lifts the hat and streamlines executive actions

The chief-keeper monitors and interacts with DSChief and DSSSpells, which is the executive voting contract and a type of proposal object of the Maker Protocol.

Its purpose is to lift the hat in DSChief as well as streamline executive actions.

To lift a spell, that spell must have more approvals than the current hat. The approvals of this spell can fluctuate and be surpassed by other spells, some of which could be malicious. This keeper "guards" the hat by ensuring the spell with the most approval is always the hat. The chief-keeper does this in order to maximize the barrier of entry (approval) to lift a spell to the hat, thus acting as a "guard" against malicious governance actions.

While in operation, the chief-keeper:

Monitors each new block for a change in the state of executive votes

lifts the hat for the spell (yay) most favored (approvals[yay])

Schedules spells in the GSM by calling DSSSpell.schedule()

The following section assumes familiarity with the , DSSSpells, and (Governance Security Module), as well as the processes within .